Still, there’s opportunity in the field, with nearly 175,000 annual openings projected over the decade. You can strengthen your employability and opportunity for advancement with a college degree. To maintain the CB credential, you must fulfill 60 continuing education credits every three years. In terms of professional bookkeeper hiring potential, there is little difference between the two designations. Both are nationally recognized and well-regarded by accounting professionals.

Certified Public Bookkeeper License Bundle (Courses and Exams) – Save 36%

- A bookkeeper certification tells employers that you have all the skills and expertise required for advanced bookkeeping.

- Learn more about bookkeeping, how it differs from accounting, the required qualifications, and bookkeeping jobs and salaries.

- Bookkeeping is a crucial function of accounting, and earning a bookkeeping certification is a great way to show employers your expertise.

- ED doesn’t necessarily approve all certificate programs at all accredited schools for federal student aid.

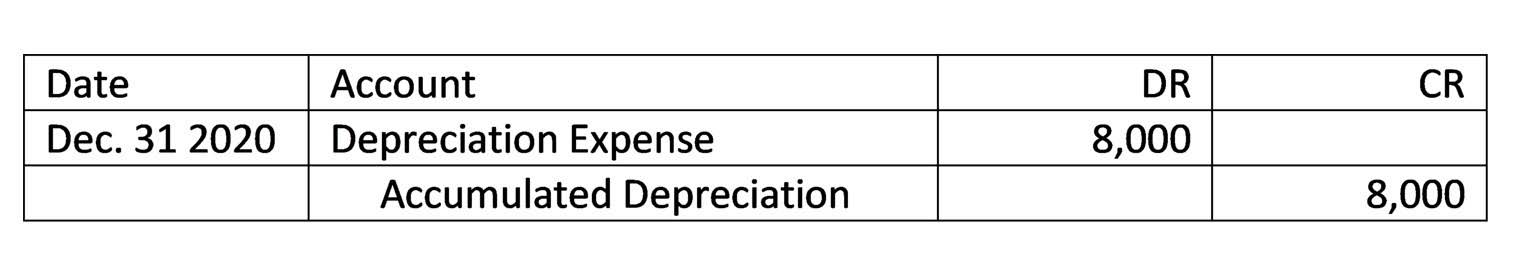

However, distance learning is not necessarily the right choice for all students. Consider the factors below when choosing to earn an in-person or online bookkeeping certificate. Students can complete Minnesota State College Southeast‘s bookkeeping certificate completely online, in person, or through a https://www.bookstime.com/articles/what-is-the-accounting-journal-entry-for-depreciation hybrid combination of online and in-person classes. The program prepares students to start bookkeeping or accounting careers after just one semester. The curriculum covers basic payroll, inventory and correction of accounting errors, and bank reconciliation.

How to write a bookkeeper resume: Examples and tips

If you become a QuickBooks Live bookkeeper, you can work from home based upon an agreed schedule at a set hourly rate based on your location, interview, and experience level. Typically, single entry bookkeeping is suitable for keeping track of cash, taxable income, and tax deductible expenses. You may handle payroll functions as a bookkeeper, keep tax withholding records, and issue paychecks or send information to a contracted payroll service. Depending on the organization’s size, keeping track of business expenses and reconciling business statements may be your responsibility. Bookkeepers play a vital role in the business accounting cycle by collecting and inputting data. As a detail-oriented professional, you would play a crucial role in the organization and growth of companies from small businesses to major corporations.

Requirements

- These include certifications in bookkeeping, payroll, QuickBooks Online and accounting.

- This could include how a business tracks client invoices, bills, receipts, or other purchases.

- These exams test your knowledge of analyzing business transactions, payroll taxes, financial statements, and more.

- AIPB and NACPB each have different educational and professional requirements to obtain certification.

- Consider the factors below when choosing to earn an in-person or online bookkeeping certificate.

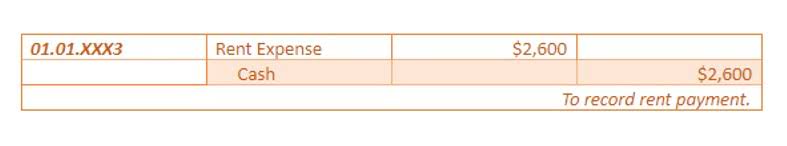

This could include how a business tracks client invoices, bills, receipts, or other purchases. Bookkeeping may also include https://www.instagram.com/bookstime_inc the creation of financial statements and processing payroll. You can learn bookkeeping for free and at a low cost through online courses.

- As more people move to working from home, freelancing, or starting their own businesses, you may want to learn how to become a virtual bookkeeper.

- Consider a bachelor’s degree in accounting, business administration, or finance.

- The Bureau of Labor Statistics (BLS) projects a 5% decline in bookkeeping occupations from 2023 and 2033.

- Learn about bookkeeping, typical responsibilities, how to become a bookkeeper, and remote bookkeeping opportunities with Intuit’s QuickBooks Live in the U.S.

- Typically, single entry bookkeeping is suitable for keeping track of cash, taxable income, and tax deductible expenses.

- It is the minimum degree required for any accounting license programs you may wish to take, such as the CPA examination.

Steps to a Bookkeeper Career

There are a lot of cheap bookkeeping courses online and a lot of free content too. You can find bookkeeping courses on standard bookkeeping work tools like bookkeeping software and financial reports. Certain aspects of bookkeeping may be difficult for some, requiring familiarity with the record-entry process and accounting software.

- Take advantage of practice exams, study workbooks, and other online resources to brush up on your bookkeeping skills and knowledge.

- Some provide free and low-cost resources, while others may be more expensive but provide more knowledge.

- You can strengthen your employability and opportunity for advancement with a college degree.

- Both offer similar benefits regarding membership, resources and renewable credentials.

- The certified bookkeeper exam can be challenging without bookkeeping experience or education.